All winter long I keep our FuelSnap community apprised of heating oil price trends in my weekly email. As we enter the off-season, I tend to reduce the frequency of these emails to once a month. In April, after a mere 3 weeks, I decided to see where things stand and send another update. In the past three weeks alone, heating oil prices have shot up 29%!

In this post I’ll break down how the ongoing war between Russia and Ukraine is impacting heating oil prices at home.

Current State Of Heating Oil Prices

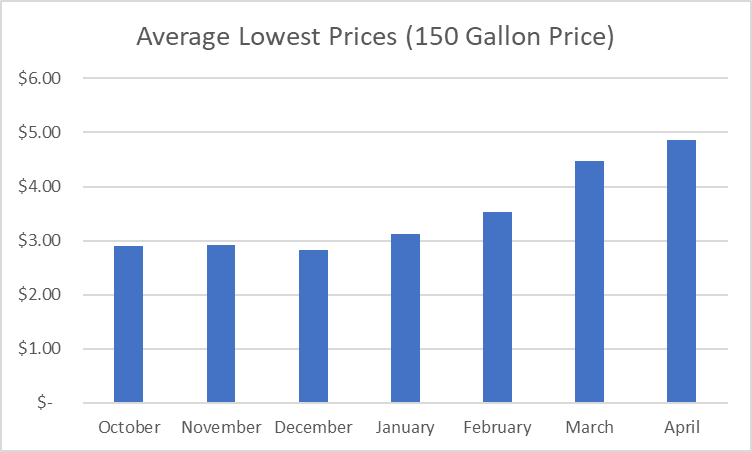

The first few months of this year’s heating season were relatively uneventful. Prices hovered in the $2.80 to $3.10 per gallon range, which is higher than the year prior, but otherwise typical. As we entered 2022, it became more and more likely that Putin would invade Ukraine. The invasion officially began on February 24, 2022, and we saw oil prices immediately rise.

Prices in February averaged over $3.50 per gallon, and that was not the end of it. Prices stabilized briefly, and then continued upward to an average of nearly $4.50 in March, and nearly $5.00 for April.

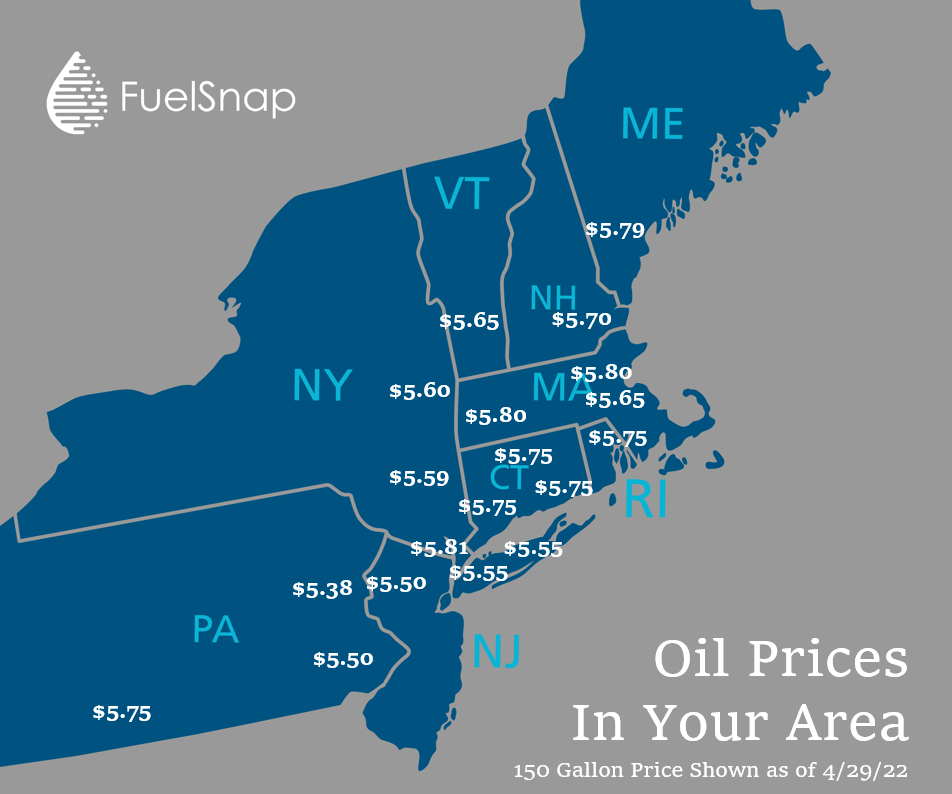

As I write this, prices have shot up significantly this week to an average of $5.66 throughout the Northeast.

Russian Oil Output Has Decreased Significantly

With the obvious tension that the war in Ukraine has created, Russia’s overall oil output is expected to be down by 17% this year. This will have a significant impact on the global supply of oil. Many European nations depend on Russian oil and will now have to look elsewhere.

Meanwhile, as the global economy has begun to rebound from COVID-19, demand for oil remains strong. Even the current lockdowns in China are not having a significant enough impact on demand to slow down these price increases. Remember, when demand outweighs supply, prices rise. Conversely, when supply outweighs demand, prices fall.

This was the case in April of 2020 when there was simply too much oil being produced. Suppliers were literally paying to have their oil taken (the price for a barrel of oil was technically negative) because they needed room for storage. Heating oil was available for as low as $0.99 per gallon two years ago!

Energy Traders Are Driving Prices Higher, Despite Our Energy Independence

Perhaps the most perplexing aspect of the conflict in Ukraine is the impact it’s having on oil prices in the US. After all, we have been, on average, Net Exporters of energy since the final year of the Trump administration in 2020. This means that we, as a nation, produce more energy than we consume and are therefore able to export the remaining oil, coal and natural gas.

Why, then, are we being so adversely impacted by the events overseas? The reason comes down to futures trading. Highly sophisticated traders at banks and energy companies are trading futures contracts and profiting vastly.

These trading effects are overshadowing any actual supply-and-demand price impacts. These trades are based on speculation and unfortunately consumers end up paying more as a result.

Fingers Crossed that Prices Will Decline This Summer

Despite increased production in the US, oil prices have continued to climb this year. The one thing we should be grateful for, however, is timing. We are currently on the tail end of this year’s heating season, so we can all lower the thermostats for a while.

We will be watching for changes over the coming months, and urge everyone to check prices regularly and keep a close eye on their tanks this summer. Take advantage of any dip you can, and hopefully prices will drop before fall comes around.

Happy spring,

Steve