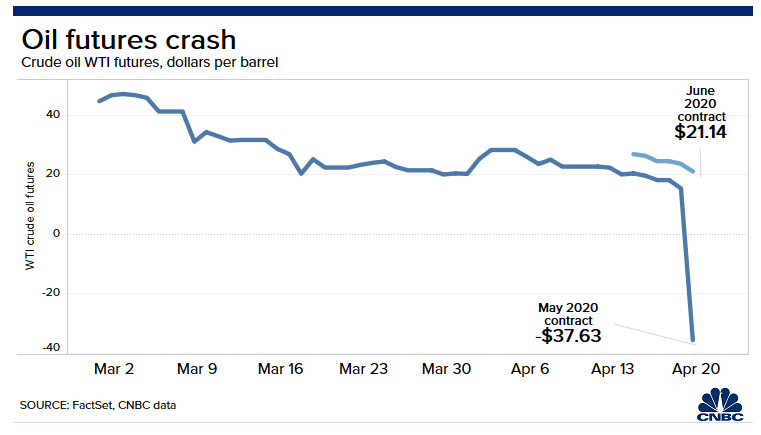

Negative oil prices?! Yes, you read that right! But no, you will not be paid to fill your heating oil tank. Oil prices have tumbled dramatically in recent months, and just when we thought they could not get any lower – they have. Here’s a snapshot of what’s going on right now.

In the past two months, the COVID19 pandemic has virtually ground the US – and the global economy – to a screeching halt. Planes aren’t flying; kids aren’t going to school, and nearly all non-essential businesses have been ordered shut. In fact, travel has been so significantly reduced, that car accidents have dropped a whopping 50% in recent weeks. And crazier still, futures contracts for Crude Oil are so undesirable, the traders are literally paying for them to be taken off their hands.

No Demand For Oil, and Nowhere to Store It

How can oil prices be negative? The explanation comes down to futures contracts. What happens in the oil markets is traders buy futures contracts as an investment. An oil futures contract is an agreement made today to buy a quantity of oil at a predetermined date in the future for a predetermined price. A futures trader is hoping that by the time that date actually arrives, the value of that oil is greater than the agreed upon price. If that’s the case, the trader sells the contract to someone else, for a profit. In other cases, the oil price may have dropped, and the trader takes a loss.

In the case of the May futures contracts (oil that someone has agreed to take delivery of in May), there is so little demand for oil, that no one wants it! With planes not flying, and cars not driving, there’s just nobody using oil at the moment. As a result, all of the storage tanks and tankers that store oil between the refineries and the gas pumps are already full. There’s simply nowhere to store the oil!

Why Would Anyone Sell at a Negative Price?

If a trader purchases a contract to take delivery of oil in May, and fails to sell that contract, then that trader is obligated to actually receive the barrels of oil that were ordered. The problem is, a trader is sitting behind a desk somewhere, and has no way of actually taking those barrels and processing them. So the trader’s only option is to do everything possible to sell those contracts. In this case, this means actually paying someone to take possession of the contracts, and thus the oil.

What This Means for Heating Oil Prices

Fortunately, heating oil prices are at historically low levels at the moment. In Long Island, we’re seeing prices as low as $1.19 per gallon, with prices in the rest of the Northeast hovering around $1.49. Traditionally higher-priced areas such as the Albany, NY area and Maine are a bit closer to $2.00 per gallon still.

With this in mind, prices may fall slightly, but are not likely to go too much lower. The downstream players (e.g. heating oil companies) do not have the same urgency to offload incoming oil as the producers who are pumping the oil out of the ground. The crude oil still needs to be stored, refined, and transported to the terminals where heating oil trucks fill up. All of these steps are costly and ultimately get factored into the price before trucks start rolling. Since oil dealers often work on a fixed ‘cents per gallon’ markup, there’s only so much lower heating oil prices can go.

With that in mind, if you’ve got room in your tank, now would be a perfectly reasonable time to fill up.

Happy Spring everyone,

Steve